The dental lab industry may be one of the last to jump on the digital bandwagon, but like so many industries before us, its inevitable change is happening now. This era of spending long hours mastering the art of the profession and hand making a tooth—and the way of life in the dental lab, is drawing to a close.

To get a sense of where the industry is headed, let’s look at the facts:

- Demographics – the average age of a lab owner/manager is 51.8 years old which means a good portion of lab operators will be retiring by 2030. The average age of a dentist is about the same for many labs, their largest clients will also be retiring.

- Disruption – here come the tech companies. Many technology-based companies are investing billions into this space because they see the opportunity to change the way business is done: Align Technologies, Carbon, Sirona, 3Shape, FormLabs, Uniform Teeth, Candid, SmileDirectClub, Orthly, plus dozens more. They are approaching the market very differently from traditional manufacturers and are driven to scale up.

- DSOs – dental service organizations are consolidating dental practices and changing the demands on dental labs. They are centralizing purchasing and changing the dental lab – dental practice relationship.

- Esthetics – patients have higher demands for education, information and aesthetics. The patient is suddenly in the loop – so brand awareness of procedures, products, materials and lab reputation are more important than ever before.

- Economics – the average lab operates at a 14% or lower operating profit. In 2017, about 90% of labs were the same or lower in profits. The capital required for training and development, hardware and software technology, plus middle management development will drive consolidation of medium-sized labs.

- Electronics – a new flow of information (patient-digital prescription-digital impression- treatment design and delivery – data management) will lead to scalable, machine-aided manufacturing, production and marketing. We’re looking at a much more automated and data driven dental laboratory.

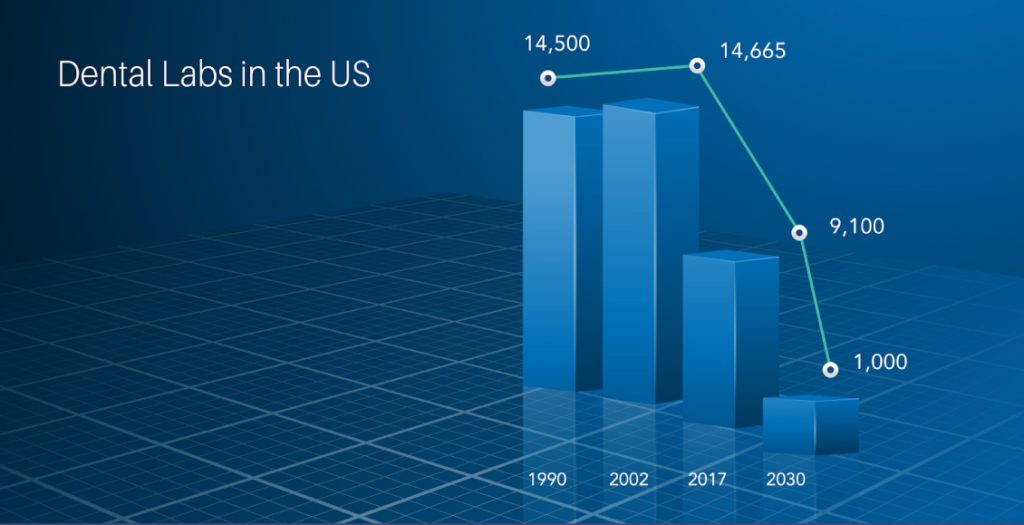

Year – Number of labs

1990 – 14,500 labs

2002 – 14,665 labs

2017 – 9,100 labs

2030 – 1,000 – 2,000 labs (my estimate)

(See the attached graph above)

If the current trends don’t change, we can expect to have only 4,000 labs by 2030. However, I see the numbers going as low as 1,000-2,000 labs.

The good news?

You are the experts in dental restorations and the number of restorations being produced will be the same if not more – so there is still massive opportunity in the industry. The labs that thrive in this changing environment can be very profitable and have higher volumes than even today’s labs.

How do you thrive in a new lab world?

- Park your ego. The modern dental lab is a manufacturing and information management business. High quality products are just one part of the business. It becomes the minimum expectation. There is also sales, marketing, production management, finance and quality control to consider. They are ALL important. I am not suggesting you hire them all right now – but start looking for the resources that can help you. Oh, but you’re too busy to get off the bench? Now you know what I mean when I say many labs won’t survive.

- Start educating yourself. Attend meetings – the NADL, Cal-LAB, Chicago Midwinter, IDS, etc.-to see how technology is evolving. It is now a business and these are some of the best places to see what people are developing and discussing.

- Re-design the workflow in your lab. I see two kinds of labs – Multi-site labs with over $200 million in revenue (multi-site operations with a combination of centralized manufacturing, management and local milling/printing) and owner/operated boutique labs that operate with around six employees and generate over $2 million in revenue (with a combination of in-house milling/manufacturing and outsourced suppliers). Both can be profitable models that provide healthy returns for their owners and investors.

- Work with the technology. There is new computer design and manufacturing software coming out all the time. Consider intra oral scanners like Straumann, 3Shape, Dental Wings, Sirona, Ormco, Condor, Medit, Viz or Carestream. More importantly, invest in an analytics software like Evident to easily manage your lab business. We are at the start of reinventing an industry!

- Get to know outsourcing partners. Companies like Argen, CAP, Ivoclar, Zahn, Panthera, and dozens more are reinventing the lab – supplier relationship. And companies such as Amann Girrbach are even positioning themselves as part of the in-house movement.

- Prepare your lab for sale. If you are not into evolving your business, it may be time to sell. There are half a dozen companies acquiring labs, including National Dentex, DSG, Leixir, Apex Group, Beacon Bay and several Asian and European groups. They follow a fairly similar process that includes Letter of Intent, Due Diligence Review and Purchase. I have been through this process dozens of times as a buyer and a few times as a seller. To get the most value, you must: prepare, prepare, prepare. Make sure you have the right records so that someone doing due diligence can look at accurate financial statements, prescriptions and doctor history and see the ability to easily transition a team. The more reliable your records, the better the value.

In all these cases, invest in the software that will form the backbone of your business. Do the math: there are about 200,000 dentists in the United States. If each boutique lab can handle 100-200 dentists, that leaves room for 1000-2000 labs. You can do it if you choose to!

** Data compiled from National Association of Dental Labs, Ivoclar and Evident.

Paolo Kalaw: A Visionary Leader in Dental Lab Consolidation and Technology Investment

From the Grind to the Boardroom: Leading Dental Lab Consolidation.

From the Grind to the Boardroom: Leading Dental Lab Consolidation.

Paolo Kalaw’s journey in the dental industry is a remarkable tale of entrepreneurial spirit, vision, and strategic acumen. Starting with a small, five-person dental lab operation where he himself worked “on the bench, waxing and delivering cases,” Paolo led the company to become one of the largest dental lab groups in North America within nine years. This meteoric rise, achieved through a combination of strategic acquisitions, operational excellence, and a deep understanding of the industry, solidified Paolo’s position as a leading figure in dental lab consolidation.

Paolo’s success story wasn’t without its challenges. His team meticulously evaluated the financial health of hundreds of dental labs, ultimately acquiring and managing dozens of independent operations. This involved calculated risks and tough decisions. Some acquired labs thrived, generating impressive earnings exceeding 30%, while others, deemed unsustainable, were shut down. Building labs from the ground up also presented its own set of uncertainties, with some ventures flourishing and others falling short. Yet, through calculated risks, a keen understanding of the industry, and a commitment to excellence, Paolo navigated these complexities, ultimately building a formidable dental lab empire.

Beyond Consolidation: Investing in the Future of Dental TechnologyToday, Paolo’s focus has shifted towards shaping the future of dentistry through his private investment firm, Nimbyx Capital. Recognizing the transformative potential of digital technology, Nimbyx has provided financing to leading dental technology companies like the Frontier Group, dental clinics like Alina Orthodontics, as well as various other technology companies in dentistry including Evident. This strategic investment reflects Paolo’s continued commitment to innovation and growth within the dental industry.

What is Evident?

Evident is the world’s #1 dental outsource partner for dentists, dental labs, and dental manufacturers looking to grow their business by leveraging digital workflows.

- Dental CAD Designs

- Workflow Solutions

- Education Programs

- Marketing Solutions

- Purchasing Solutions